Blackrock: Wtp leads to more adjustments in interest rate hedging

This article was originally written in Dutch. This is an English translation.

The Wtp introduces dynamics that lead to more frequent adjustments of interest rate hedging. This article sheds light on that phenomenon based on various market scenarios. The results confirm the importance of adequate liquidity management.

By Willem van Dommelen, Multi-Asset Strategies & Solutions at BlackRock and Thijs van der Groen, LDI Client Portfolio Management at BlackRock

Under the Future Pensions Act (Wtp), investments are made in accordance with the lifecycle principle. This means that participants receive (explicitly or implicitly) an age-dependent asset allocation and interest rate hedging. Compared to the Financial Assessment Framework (FTK), the expected pension benefits are more variable because they move more in line with developments in the financial markets. This affects the amount of interest rate risk (PV01) that must be hedged.

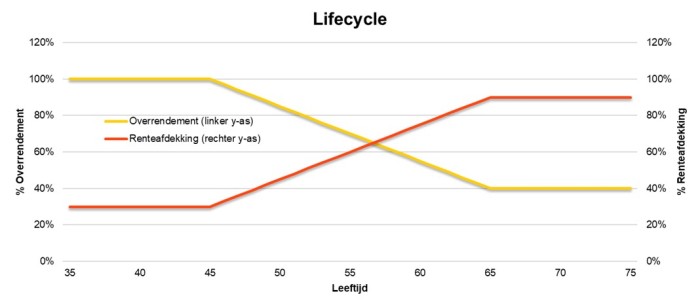

In accordance with the lifecycle principle, young people have greater exposure to high-risk investment categories such as shares and real estate than older people. For the elderly, a larger part of their interest rate risk is hedged to provide more certainty about their (expected) pension. An example of a lifecycle is shown in Figure 1. Based on the lifecycle, the achieved investment results and the prevailing market interest rate, the expected pension payments are calculated periodically.

In a generic sense, a positive return on high-risk investment categories leads to an increase in capital and also in the expected pension. This means that more interest rate sensitivity (PV01) must be hedged.

The impact of interest rate movements is related in a different way. If the interest rate risk is not fully hedged, changes in the interest rate have the opposite impact on the capital in relation to the expected pension. All other things being equal, a higher interest rate causes a decrease in the invested capital (as a result of a negative result on the interest rate hedge). However, because this decrease is less than the decrease that would be realised with full interest rate hedging, the expected pensions that can be achieved with this capital will increase. This also increases the amount of interest rate risk to be hedged.

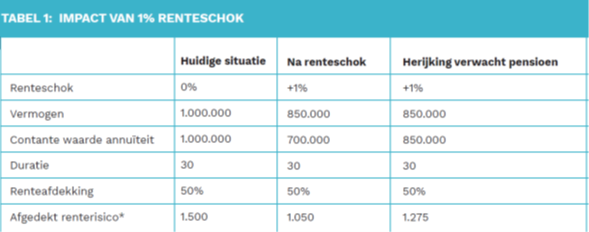

Table 1

*hedged interest rate risk defined as PV01 of the annuity cash flows: price of annuity x duration /10,000

Source: BlackRock:

This is an illustrative example only.

In Table 1, we describe this concept using a simple example. We look at the impact of a 1% interest rate shock on the hedged interest rate risk for a participant with 1 million in assets. We do not take convexity into account here.

- For a participant with a duration of 30 years, where 50% of the interest rate risk is hedged, the present value of the annuity (the expected pension) is equal to the capital.

- After an interest rate shock of 1%, the present value of the annuity drops to 700,000 (a 30% drop due to a 1% shock with a duration of 30 years). The participant's assets drop by 15% to 850,000 because he has hedged 50% of the interest rate risk.

- The participant can use this to purchase a higher annuity (pension), which increases the interest rate risk.

Impact of market movements on interest rate sensitivity

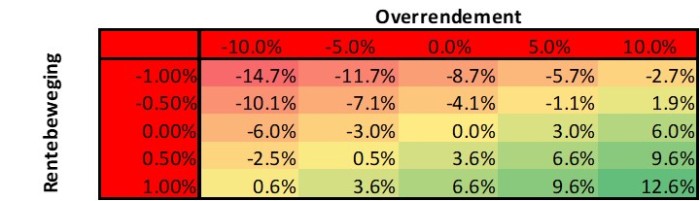

The dynamics described above are further elaborated using a theoretical example. This is based on the lifecycle shown in Figure 1. Figure 2 shows the relative impact of both a share and an interest rate movement on the interest rate risk to be hedged. For context: the average monthly (10-year) interest rate movement over the past 10 years was 0.15% and for shares 3.5% (S&P 500).

Figure 1: Lifecycle

Source: BlackRock

This is purely an illustrative example.

Figure 2: Impact on interest rate risk in the event of changes in interest rates and returns

Source: BlackRock

This is purely an illustrative example.

If interest rates do not change and shares rise by 10%, the interest rate risk increases by 6%. With an interest rate increase of 0.5% and stable stock markets (0% excess return), the required interest rate hedge increases by 3.6%. A combination of an interest rate increase and positive stock markets causes the required interest rate hedge to increase by almost 10%.

Although Dutch pension funds that operate under Wtp (or will do so in the future) differ in terms of their membership base and lifecycle, they will all be confronted with these effects. This creates the risk that they will have to make similar adjustments to the interest rate hedge in the event of significant market movements and at the same time have to trade tens of millions in PV01.

As described, the interest rate sensitivity of the matching portfolio must be increased when interest rates rise. This is despite the capital decreasing. Where interest rate derivatives are used, this means that the available liquidity to meet any collateral requirements decreases.

Increases in the return portfolio have less of an effect on the liquidity buffer. This is because the increase in the risk to be hedged is accompanied by an increase in the capital that can be used as collateral.

Conclusion

Under the new pension contract, market fluctuations have a greater impact on the level of the pension and the interest rate hedge. It is important for pension funds to be aware of these dynamics. This is particularly true because the pension industry as a whole is dealing with the same dynamics, and there is therefore a chance that pension funds will have to carry out the same rebalancing transactions at the same time. This causes increased demand (or supply) on the market for a short period and possibly increased transaction costs as well as extra pressure on interest rates.

Although good liquidity management was already important under the Financial Assessment Framework (FTK), these new dynamics require adequate liquidity buffers and extra attention for collateral policy.

|

Summary Under the Wtp, market fluctuations have a greater impact on the level of the pension and the interest rate hedge than under the FTK. In general, a positive return on high-risk investment categories leads to an increase in capital and the expected pension, but also to higher interest rate sensitivity. Despite the fact that Dutch pension funds differ in terms of membership base and lifecycle, there is a risk that under the Wtp they will have to make comparable adjustments to their interest rate hedging at the same time as significant market movements. |

|

Risk warnings Investment risk. The value of investments and the income generated can fall as well as rise. It is possible that investors will not recover their initial investment. This is a marketing communication. This material is intended for professional investors only (according to the definition of the AFM and the MiFID directive). Other persons should not rely on the information provided here. Issued by BlackRock (Netherlands) B.V., which is licensed and supervised by the Netherlands Authority for the Financial Markets (AFM). Registered office: Amstelplein 1, 1096 HA, Amsterdam, tel: 020 – 549 5200 /+31 20 549 5200. Registered in the trade register under no. 17068311. For your protection, telephone calls are usually recorded. © 2025 BlackRock, Inc. All rights reserved. MKTGH0125E/S-4189581 |