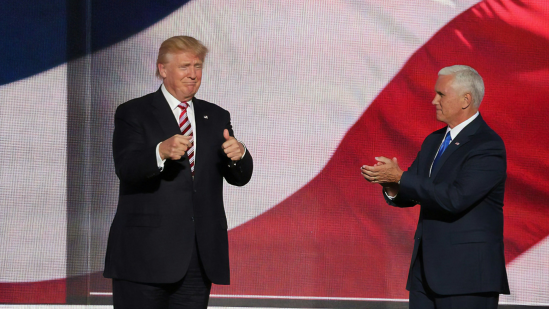

La Française: The doge, the new king's fool

- Trump favors national interests, with controversial positions on NATO and international help.

- The US economy remains strong, supported by tax cuts and expected earnings growth.

- Social divisions and the budget deficit limit market optimism.

- Beijing is reviving its economy, while some are calling for stronger climate commitment.

The rise in US markets following Donald Trump’s victory also reflects the anticipated red wave in Congress. Investors are therefore expecting the new government to act strongly and quickly on the campaign promises.

Washington, the new serenissima, do not turn away from the lagoon!

The focus on national interests at the expense of the rest of the world is looming: Make America Great Again. While support for Israel seems unwaverred, sending military aid to Ukraine and a NATO exit are on the agenda. Marco Rubio's appointment as Secretary of State is reassuring, but he is accompanied by Pete Hesgeth as Secretary of Defence, a US Army veteran and Fox News's flagship presenter.

On the economic front, the domestic market takes the lead, bolstering U.S. capitalism through extended corporate tax cuts, bank- and tech-friendly deregulation, and the implementation of tariffs targeting global trade partners. Trump's fortune is he can count on a relatively healthy economic growth. The US consumers and US Corporates are in good health, have low debt and show confidence in the economy (US CEO confidence index is at its highest level since January 2022). Earnings expectations point to a 13% growth in EPS next year while real rates remain at moderate levels (2.1%) and the unemployment rate is contained (4.2%).